ComfortDelGro’s quiet tech play and why it’s not sweating GrabCab

Grab says it won’t poach rival drivers, but its entry may intensify Singapore’s tight market

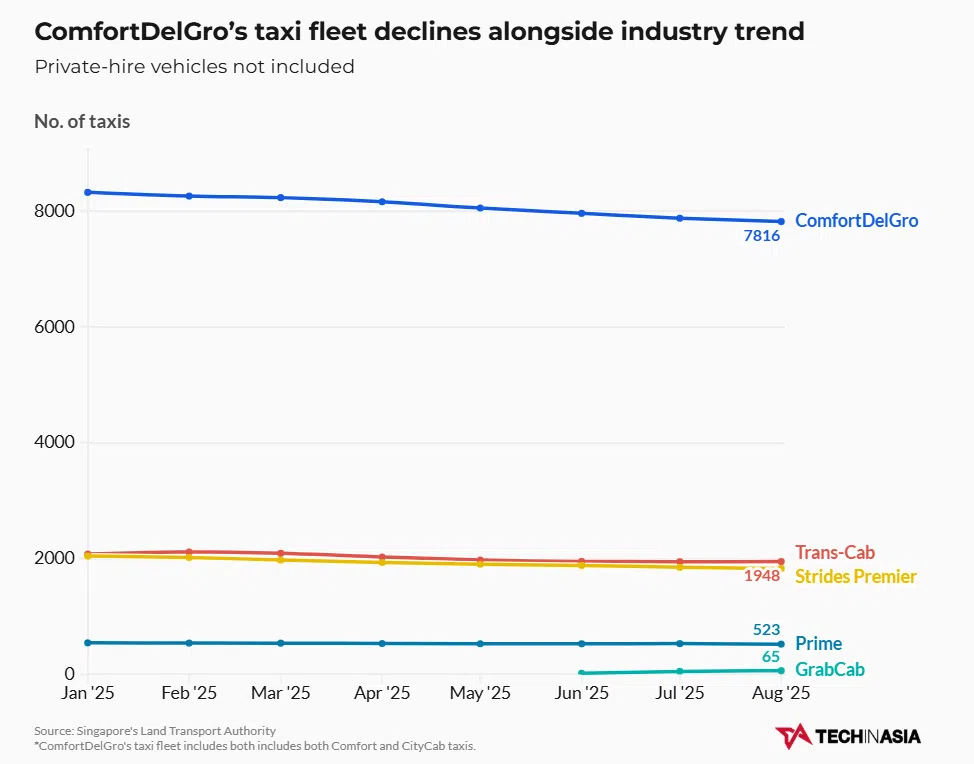

[SINGAPORE] Within just a decade, Grab has gone full circle from an entrant challenging incumbent taxi companies to becoming one itself. In July, three months after getting a street-hail license in Singapore, it launched its own taxi service GrabCab. With 65 taxis signed up as of August, the company plans to hit 800 within three years.

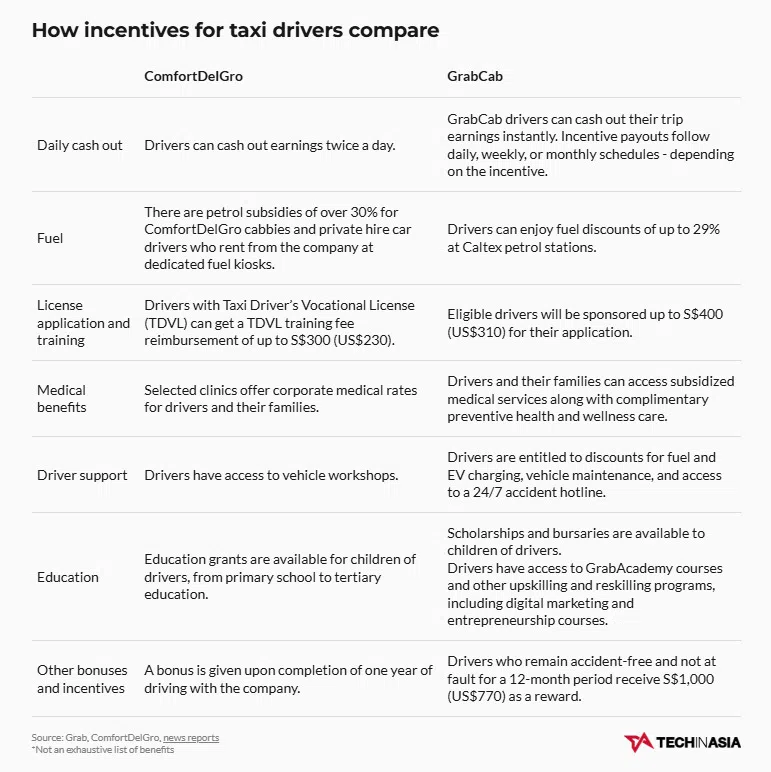

The tech company says it doesn’t intend to attract drivers from rival car companies. But its entry – which comes with generous driver incentives typical of the super app – could stiffen competition in the city-state, where drivers are already in short supply.

Even so, ComfortDelGro, Singapore’s largest taxi company, is drawing on decades of experience to stay competitive. It also has a few plans up its sleeve.

The firm’s back-end booking system underwent a revamp last year, making way for new features and products. One of them will make the Zig app usable in markets outside of the city-state, Michael Huang, head of ComfortDelGro’s Singapore point-to-point mobility business, tells Tech in Asia.

This upgrade suggests that while the competition for both driver and passenger dollars in Singapore is heating up, the real competition lies beyond.

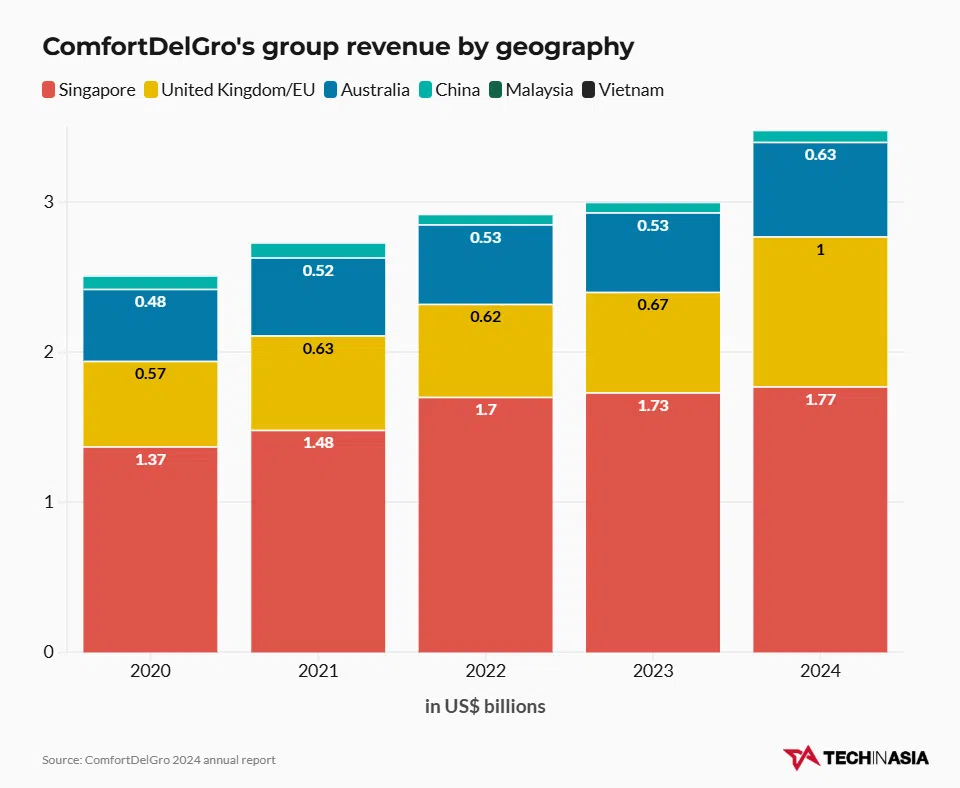

The city-state is the firm’s largest market, but its share of group operating profit – which totaled S$322.9 million in 2024 – is shrinking as overseas markets like the UK become more profitable.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Despite increasing to S$210.3 million in 2024, Singapore’s contribution to operating profit fell from 74 per cent in 2023 to 65 per cent by 2024.

Last year, the company recorded S$4.5 billion in revenue across its various businesses, which include public transport, taxi and private hire, and inspection and testing services.

The next big thing

After revamping its booking system and moving to a cloud-based architecture last year, ComfortDelGro is now working on several improvements to the Zig app, Huang says.

Cross-border functionality is one of them.

In the near future, a Zig user in Singapore will be able to book a cab in London via the Zig app, while the same would be possible for a UK user visiting Singapore.

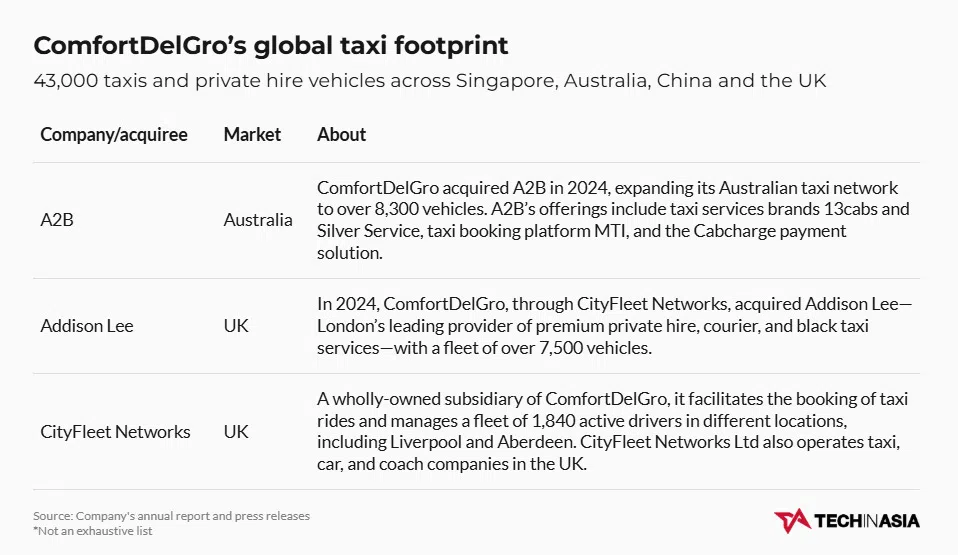

Customers of taxi company A2B in Australia who are traveling to Singapore might be able to do the same. ComfortDelGro completed its acquisition of the firm last year.

Huang says ComfortDelGro is working on the feature’s “technical” components. However, he did not share a timeline for when it will go live.

Many ride-hailing companies already let users use their apps in multiple countries. A Grab user in Singapore, for instance, can also use the app to book a ride in Indonesia, Thailand, or any other Southeast Asian markets, and vice versa.

With the Ride Abroad feature, Grab users can pre-book trips in over 140 cities. Trips are fulfilled by local taxi or ride-hailing companies in each location.

Huang says last year’s infrastructure investments have laid the groundwork for ComfortDelGro to roll out more features in the upcoming months.

Among them is a more responsive pricing mechanism and a feature that helps customers find matches at least 10 per cent faster. Rolling out a six-seater vehicle option is also in the works.

Later this year, the company will allow less tech-savvy seniors to book rides by scanning physical QR codes.

ComfortDelGro is also working to make pricing and dispatch more localized to a smaller area of a “couple of square meters” in the coming year. The goal is to contain surge pricing in areas of high demand.

Taking a leaf from China’s book

Huang, who was CEO of ComfortDelGro’s China business before taking on his current role in June 2025, says the country offers a blueprint that Singapore companies can follow.

In China, ComfortDelGro operates a commercial autonomous robotaxi fleet of about a dozen cars together with tech partner Pony.ai.

Users in Guangzhou can already hail a robotaxi via the PonyPilot or Amap app within a geofenced area of about 800 square kilometers – bigger than Singapore’s land size.

Under these trials, autonomous vehicles make 20 per cent to 25 per cent more daily trips compared to those driven by humans, Huang shares.

Being in China gives ComfortDelGro exposure to nascent tech like autonomous and electric vehicles, he points out. Some insights from this immersion are being applied to pilots in other markets.

In Singapore, for example, the firm is set to launch a Pony.ai-operated autonomous shuttle service that runs on a fixed route by the second quarter of 2026.

Tackling the supply issue

Like all firms in Singapore’s mobility sector, ComfortDelGro is facing a persistent driver shortage in the city-state.

GrabCab’s July 2025 entry hasn’t affected driver numbers for the firm, according to Huang.

But even without the pressure of a new taxi entrant, the size of ComfortDelGro’s taxi fleet has been steadily declining, data from Singapore’s Land Transport Authority show.

“The unfortunate fact is that the whole industry is shrinking,” Huang says.

In Singapore, only citizens can apply for a taxi driver or private-hire car vocational license. This restriction further limits the number of drivers on the road.

To entice more drivers to join its fleet, ComfortDelGro has introduced flexible rental periods, including weekend-only options.

Last year, the firm launched a driver-employee scheme offering drivers a base salary of S$1,800, alongside benefits like annual and medical leave.

In the typical taxi model, drivers earn based on the number of trips they complete, minus fuel and other vehicle costs.

Huang says the monthly salary under the scheme has been increased to S$2,100. So far, roughly 100 people have signed up and progressed to other rental models, which is the intention rather than keeping large numbers of drivers on the scheme.

Still, it’s unclear if such arrangements can reverse a broader industry decline, as rising fuel costs, lower incentives, and other better-paying job alternatives continue to shrink the driver pool.

Entice, entice, entice

Ultimately, taxi drivers will choose the operator that offers the most competitive package.

In 2017, Grab onboarded some 3,000 ComfortDelGro taxi drivers within a month through aggressive rental discounts.

Analysts point out that, as a platform operator, Grab has a leg up on pure taxi fleet operators. For example, it could incentivize drivers by offering lower rental rates if they commit to providing “a certain amount of service on the platform.”

ComfortDelGro’s commission structure for drivers is straightforward: S$0.70 per trip for taxi drivers, S$0.80 for private-hire vehicle renters, and S$1 for drivers of non-ComfortDelGro vehicles.

Huang notes that because the firm offers a hybrid model, full-time drivers can enjoy the perks of working for a large fleet operator – access to an ecosystem of ancillary services from vehicle servicing and repairs – in addition to other incentives they can clock on Zig.

Unlike “small” rental companies, ComfortDelGro also offers support for vehicle breakdowns 24/7. Huang assures that “it’s not some machine talking to you,” but a human.

Moreover, drivers don’t need to jump through hoops or fulfill a minimum number of trips to qualify for these benefits.

“We give it to you from day one,” Huang says.

In comparison, Grab charges its drivers a service fee, which can vary between -10 to 25 per cent for every completed trip on its platform.

These fees – the difference between what a passenger pays and what drivers earn on the same trip – vary depending on pick-up distance and duration, as well as demand and supply.

Metered taxi rides are subject to a S$0.60 flat fee per booking, according to Grab.

On GrabCab, drivers can toggle between ride-hail and street-hail jobs by scanning a QR code displayed on the meter with the Grab driver app. Similarly, ComfortDelGro cabs can accept both street hail and app bookings via the CDG app.

ComfortDelGro’s experience in managing a fleet means it has deep knowledge of vehicle maintenance and optimization, from selecting the right cars to maximizing their lifespan, according to Huang.

In the past five years, the firm has spent an average of S$5.5 million per annum on driver benefits and welfare, which includes education grants for their children, from primary school to tertiary education.

ComfortDelGro is, indeed, doing a lot to hold off the competition. But will it be enough?

“We’ve seen people come in,” Huang says. “This is not the first entrant… We have to just focus on what we’re really good at – providing a reliable, trusted service, taking care of [drivers], not just on day one, but all the way through.”

“The key thing about this whole business is that it’s not static, right?” he adds. “It is highly disruptive, but highly innovative… which is the fun part.” TECH IN ASIA